If you discover that your Charity has inadvertently submitted a gift aid claim for donations that Big Give was authorised to submit on your behalf, you will need to submit an adjustment to the next Gift Aid claim that you submit to HMRC.

To do this:

- download HMRC’s gift aid claim schedule spreadsheet: https://www.gov.uk/guidance/schedule-spreadsheet-to-claim-back-tax-on-gift-aid-donations

- complete columns C-K as applicable

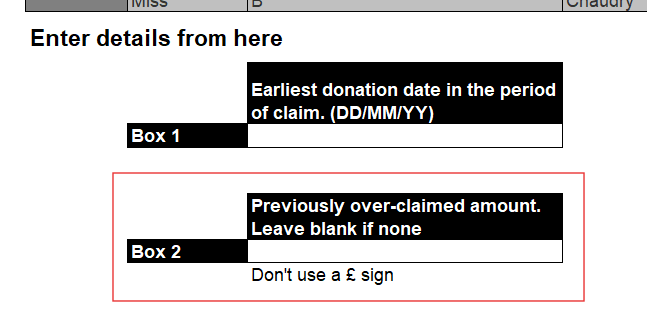

- complete Box 1 with the earliest donation date

- enter the amount that was overclaimed in Box 2. Please note that this amount needs to be less than the total amount of gift aid claimable in this submission. This amount will then be deducted from the claim you’re submitting.

Then follow the steps to claim gift aid through HMRC’s portal: https://www.gov.uk/claim-gift-aid-online?5rd5j45bsk5mrkhdanq7og656a=qudr4xlnnjvlue2pwzimt7bl5y